Asset Protection Strategies – How to Protect Your Wealth

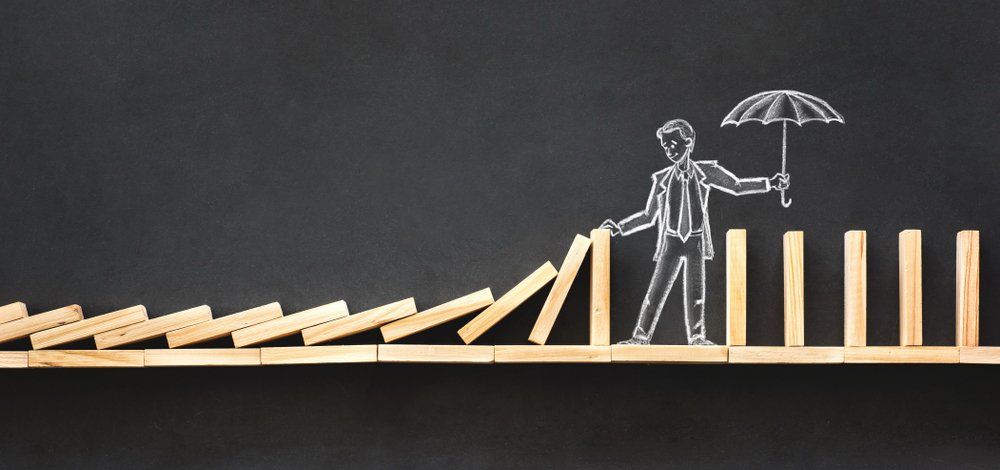

When you’re a business owner or company director, many things can go wrong. And when they do, your assets – both business and personal – are at risk. Whether you’re in the early stages of business, or have been in the game for a while, it is crucial that you take the steps towards adequate asset protection.

What does it mean to protect your assets?

Protecting your assets means putting in place legal strategies that will safeguard your wealth in the unfortunate event of a lawsuit or creditor claims. Below we outline some of the techniques individuals and businesses use to limit how much access creditors have to certain assets.

How can I protect my assets in Australia?

1. Choose the right business structure

There are multiple considerations to make before deciding on the right business structure, but in terms of asset protection, sole traders and partnerships are not the best options. In Australia, if you are a sole trader or an individual partner in a partnership, your personal assets are exposed to business liabilities. Companies and trusts offer somewhat more protection.

2. Separate personal from business

Don’t mix your business activities with your personal. You should have a separate bank account for your business, and your business name should be used on all business documents. That way if your business runs into trouble, your personal assets may have more protection.

3. Use the correct procedures

If you act negligently or don’t meet your legal obligations, creditors may have grounds to get at your personal assets. To avoid this, you should ensure your contracts, agreements and procedures are carried out professionally and meticulously. Effective and robust contracts can help limit your liability with relevant stakeholders.

4. Get business insurance

Insurance is a crucial aspect of any business to protect you if something unfortunate happens. It’s important that you get the right type of insurance for your business, as different industries are more susceptible to some events than others. Consider whether your business would benefit from an ‘umbrella liability insurance’ on top of your other insurance types.

5. Transfer assets to spouse’s name

If one spouse is more at risk of being sued in their occupation than the other spouse, it can be a strategic move to place assets in the less at-risk spouse’s name. Generally, the creditors of the at-risk spouse will not be able to touch the assets in the other spouse’s name.

6. Use trusts or other entities

Discretionary trusts are another strategy business owners can use to protect their assets. When you are the beneficiary of a discretionary trust, you don’t own any of the trust’s assets which means your creditors will have a difficult time making a claim on them. While trusts and other entities can be an effective strategy for asset protection, the finer details can be complex and professional assistance is key.

7. Speak to an expert

Even if you recognise the importance of asset protection as a business owner, it can be overwhelming to make and implement a plan. The question ‘what is the best way to protect my assets?’ may feel daunting, but speaking with an expert can make all the difference. We offer financial planning to help Australian businesses find the best way forward. Speak with us today to see how we can assist you.

This article is general information only. It does not give business, accounting, taxation, financial planning or other professional advice or service. It does not consider your specific situation, objectives or needs and if personal advice is required, a detailed analysis of your particular circumstances would need to be sought. Please see our Privacy and Disclaimers page for further information.

Related posts