Lawrence Group

David Gets His Financial Life Back on Track

About David

David needed to find a solution and fast to his ATO crisis

David discovered his former business partner had not lodged any BAS, tax returns or compliance documentation for his business for 8 years.

As if this wasn’t enough bad news, he found that they had not been paying Super and had $155,000 ATO debt.

As a result, David had not been able to even pay himself a wage for his work. His business partner was still working in the business and had withdrawn significant funds for private use.

David needed Lawrence accountants to help him save his business before the ATO closed it down.

Who:

Business owner

Age:

Established

Occupation:

Partnership

Problem:

ATO debt

Lawrence Group

How We Helped

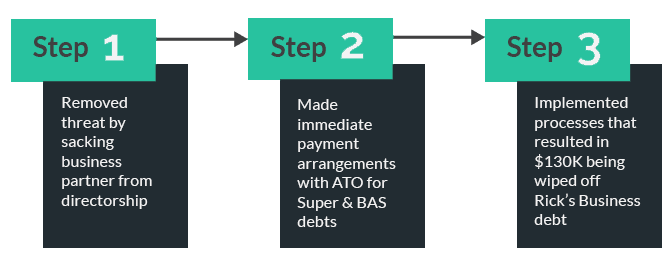

Lawrence accountants saw immediately that David needed to eliminate the current threat to the business which was his business partner, so they seized the partner’s laptop, had him removed from the premises by security and sacked him from the directorship of the company.

We then got in contact with the ATO and negotiated payment arrangements for David's super and BAS debt. We began working through all the outstanding lodgements and getting the books in order.

Finally, when that was completed we engaged a new bookkeeper. These efforts managed to save rick $130K in interest charges and fines.

David saved his business.

Ask how our Accountants/Business Advisors can help you.

The Outcome

David was back in business!

David got his financial life back on track and started winning new clients again. His business finances were in order, with a professional bookkeeper on board and he was free from the reckless financial behaviour of his business partner.

Other people that Lawrence have helped

ABC Construction Needed Finance

See how we helped a new business win a big contract by arranging equipment finance...

read more

John’s business was in debt

Here’s how we helped John out of debt after his business was strapped for cash during the mining downturn... read more

Gordon & Maria were losing entitlement

Here’s how we helped Gordon and Maria, a retired couple who were losing out on pension entitlements... read more

Jane said goodbye to bookkeeping headaches

Here’s how we helped Jane who had years of incorrect data entry and felt out of control and lost on how to fix the problem... read more