Lawrence Group

Gordon’s Pension Entitlements are Reinstated

About Gordon & Maria

This retired couple were losing out on pension entitlements

Gordon is an existing Lawrence client who got in touch after he and his wife, Maria, found their age pension was significantly reduced following changes in the asset test limits by the Government.

Gordon felt helpless in the face of these legislative changes. He knew that with an income reduction like this their plans for the future would change.

It meant that he and his wife would have to start drawing more from their Superannuation to fund their retirement.

Who:

Husband & wife

Age:

60 & 67

Occupation:

Retired

Problem:

Reduced income after pension changes

Lawrence Group

How We Helped

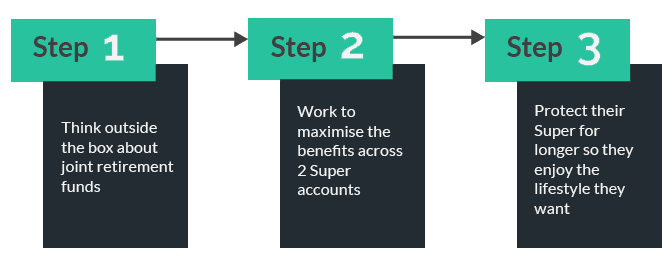

Lawrence Financial Advisors prepared advice to cash out a large amount from Gordon’s Account Based Pension and make a large personal contribution to Maria’s super.

As Maria’s super was exempt from the asset test, her husband was able to revert back to the full age pension for the next 5 years until his wife reached age pension age.

This meant they could relax and continue to enjoy their current lifestyle, secure in the knowledge that their retirement savings would last a lot longer.

Gordon & Maria avoided pension cuts. How could we help you?

Ask how our financial planners can help you.

The Outcome

$10,000 back in their pockets!

After working with Lawrence’s Business Advisors and Super specialists, Gordon and Maria have an extra $10K of pension entitlements back in their pocket every year. Their Super remains secure for a later date and they continue to enjoy the lifestyle they want.

Other people that Lawrence have helped

ABC Construction Needed Finance

See how we helped a new business win a big contract by arranging equipment finance...

read more

John’s business was in debt

Here’s how we helped John out of debt after his business was strapped for cash during the mining downturn... read more

Jane said goodbye to bookkeeping headaches

Take a look at how we helped Jane who had years of incorrect data entry and felt out of control and lost on how to fix the problem... read more

David’s big ATO problem

See how our Accountants helped David when his business partner went rogue... read more