Lawrence Group

Jane Says Goodbye to Bookkeeping Headaches

About Jane

Jane’s Not-for-Profit has a bookkeeping nightmare

Jane had several years of incorrect data entry throughout her bookkeeping system (MYOB) that was causing issues for her reporting with GST, Payroll and Super.

Jane tried to solve the problem in house and attempted the job of transferring their bookkeeping software from MYOB to Xero, which caused more problems!

After struggling with this issue, Jane knew that her team were in over their heads. They were unsure how to correctly enter the data for year-end reporting for the accountant. She was feeling out of control and lost on how to fix the problem.

Who:

Business owner

Age:

Established

Occupation:

Education

Problem:

Bookkeeping muddle

Lawrence Group

How We Helped

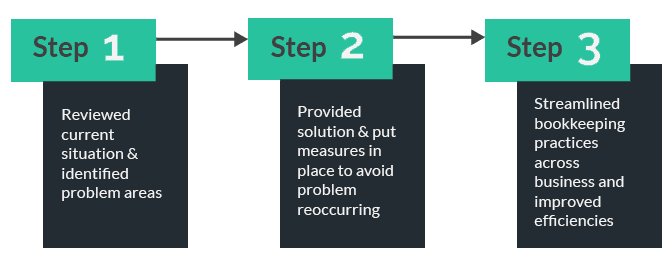

Our bookkeeping team spent time with Jane and her team understanding how they came to be in this situation. From the ground up, we audited, reviewed the data and fixed the issues. This included reviewing payroll reporting, Super and holiday accrual data to ensure all reporting was correct and up to date.

Then we worked with Jane and her team to ensure they understood their requirements going forward and how to enter items correctly. They were so relieved to have our bookkeepers onboard, they asked us to take over their reporting so they are confident in the knowledge that this is always up to date and correct.

The whole team have benefitted from outsourcing the bookkeeping, they no longer need to worry about ongoing reporting, their data entry is correct and payroll reporting is accurate. Knowing they can call on us for support and guidance into the future means they have peace of mind.

Jane said goodbye to bookkeeping headaches.

Ask how our bookkeepers can help you.

The Outcome

Jane increased efficiencies and reduced stress!

For Jane having the Lawrence Bookkeeping team onboard removed the hassle of managing this inhouse, saving her time and stress. She also saw increased efficiencies with correct use of the new software, Xero allowing her to focus on running the business rather than the bookkeeping operations!

Other people that Lawrence have helped

ABC Construction Needed Finance

See how we helped a new business win a big contract by arranging equipment finance...

read more

John’s business was in debt

Here’s how we helped John out of debt after his business was strapped for cash during the mining downturn... read more

Gordon & Maria were losing entitlement

Here’s how we helped Gordon and Maria, a retired couple who were losing out on pension entitlements... read more

David’s big ATO problem

See how our Accountants helped David when his business partner went rogue... read more